Grid modernisation investment sees rapid growth

- April 25, 2023

- Steve Rogerson

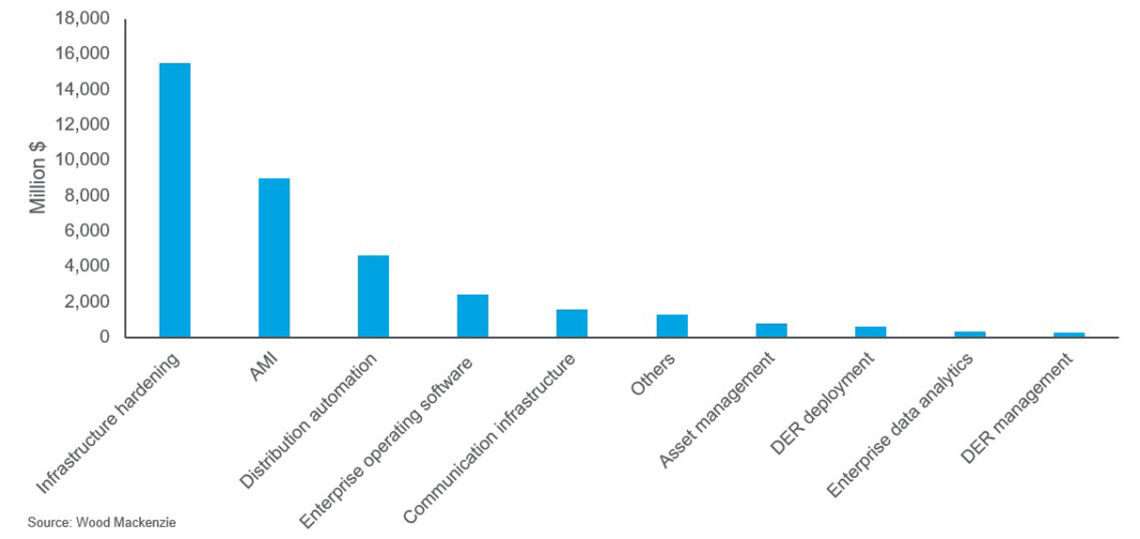

Around $36.4bn of grid modernisation is planned by investor-owned utilities in the USA, according to a report from consultant Wood Mackenzie.

Grid modernisation investment has seen 37% CAGR since 2012; the largest emphasis is on achieving higher efficiencies in the operation of the grid and protecting physical infrastructure from catastrophic weather.

To modernise distribution grids, 25 investor-owned utilities (IOUs) have filed for $36.4bn of investment. These investments have been carried over into or filed after 2018, through general rate cases, grid modernisation (GM) plans, and targeted applications based on needs, according to the analysis.

The rate of growth has accelerated in recent years, with a 71 per cent jump in investment from 2022 to 2023. This acceleration will lead to 2024 seeing the highest level of annual investment by the studied IOUs, estimated at $5.9bn.

While most GM initiatives are driven by distributed energy resources (DERs) integration and achieving higher grid operation efficiencies, recent catastrophic weather events have redirected GM expenditure back to infrastructure hardening, according to the report.

“We have seen GM investment grow exponentially in the last several years, with base rate the main cost recovery mechanism,” said Fahimeh Kazempour, head of grid modernisation for Wood Mackenzie. “However, these days regulators are showing more openness for utilities to use alternative cost-recovery mechanisms for their grid modernisation investments such as riders and cost reconciliation to limit disallowance risk and regulatory lags inherent in the rate base.”

Infrastructure hardening to protect against catastrophic weather, advanced metering infrastructure (AMI) and distributed automation represent 80% of current GM investment. Investment in DERs deployment and management is only at 2.4%, but, as most requests have been filed after 2021, they have the potential to surface as emerging GM options.

“Utilities are quoting DER integration and market enablement as the primary driver for their GM investments,” said Kazempour. “When we compare DER-driven GM investments with the level of investment in DER management, however, our data suggest that utilities are designing the grid to withstand the scale and variability of DERs rather than integrating more closely with them.”

DERs are the primary driver for advanced distribution management system (ADMS) expenditure, at almost $1bn, which subsequently is creating a boost for GIS investment as ADMS’s enabling technology.

Planned utility GM investments vary based on state and geographic needs. The southeast has focused mainly on infrastructure hardening, as the region often deals with catastrophic weather events, such as hurricanes. The northeast has demonstrated elevated levels of investment in AMI, positioning it to implement advanced rates and shape prosumer behaviour.

“These investments depend a lot on each state’s policy or regulatory environment,” said Kazempour. “Some regulators require utilities to submit long-term GM strategy and investment plans to support their states’ specific decarbonisation targets. An increasing number of regulators are allowing utilities to address their GM needs outside their rate cases. And when reliability and resilience concerns justify it, some regulators support controversial investments in capital-heavy infrastructure and utility ownership of DERs. What strategy a utility will take often depends on where they are located.”