Funding for smart grids and energy storage falls

- April 25, 2023

- Steve Rogerson

Corporate funding for energy storage companies reached $2.2nn in Q1 2023, according to Mercom Capital Group, a clean energy communications and consulting firm.

The quarterly report covers funding and mergers and acquisition (M&A) activity for the energy storage and smart grid sectors.

Total corporate funding – including venture capital (VC) funding, debt financing and public market financing – in energy storage came to $2.2bn in 27 deals compared with $4.3bn in 31 deals in Q4 2022. Funding decreased significantly year-over-year (YoY) compared with $12.9bn in 27 deals in Q1 2022. LG Energy’s $10.7bn IPO contributed 83% of Q1 2022 funding and skewed funding totals.

VC funding including private equity and corporate venture capital raised by energy storage companies in the quarter came to $1.1bn in 19 deals, an 8% decrease YoY compared with $1.2bn in 22 deals in Q1 2022. Quarter-over-quarter (QoQ) funding was 35% lower compared with $1.7bn in 22 deals in Q4 2022.

The top five VC-funded battery storage companies in Q1 2023 were: Electriq Power ($300m), Our Next Energy ($300m), WeView ($87m), NanoGraf ($65m) and Caban Systems ($51m).

In Q1 2023, announced debt and public market financing for energy storage technologies decreased 58% QoQ, with $1.1bn in eight deals compared with $2.6bn in nine deals in Q4 2022.

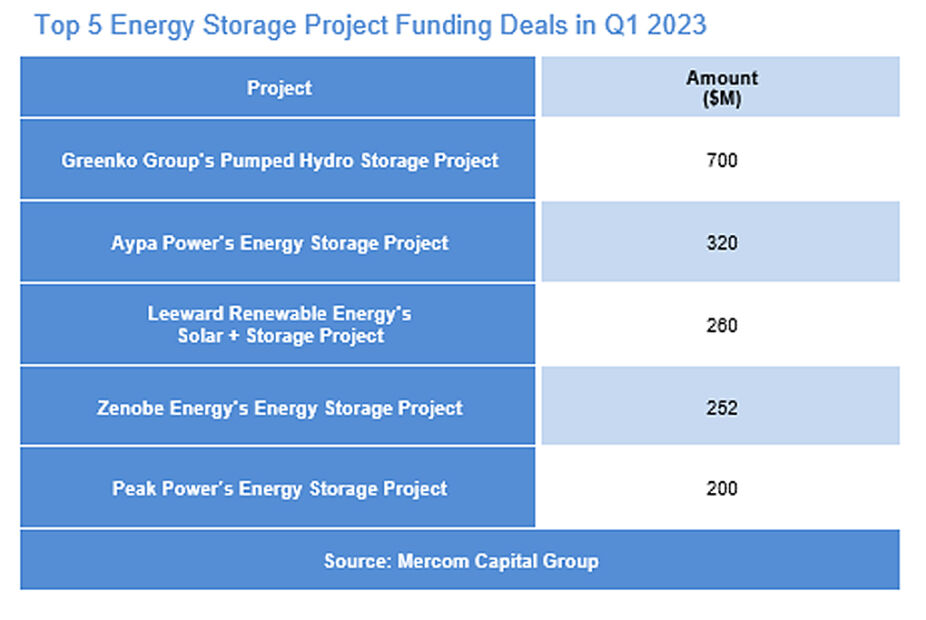

Announced energy storage project funding came in at $2bn in nine deals in Q1 2023, compared with $749m raised in seven deals in Q4 2022.

Four M&A transactions were recorded in energy storage in Q1 2023. In Q4 2022, there were five M&A transactions. YoY, there were five energy storage M&A transactions in Q1 2022. There were 12 energy storage project M&A transactions in Q1 2023.

Corporate funding in smart grid came to $1.1bn in 18 deals in Q1 2023, a 42% decrease compared with $1.9bn in 23 deals in Q4 2022. In a YoY comparison, funding in Q1 2023 increased 230% compared with $331m in 15 deals in Q1 2022.

There was a 66% decrease QoQ for smart grid VC funding in Q1 2023, with $280m raised in 14 deals compared with $846m in 15 deals in Q4 2022. YoY, funding in Q1 2023 was 14% lower than Q1 2022, when $327m was raised in 13 deals.

The top five VC funded smart grid companies in Q1 2023 were: EO Charging ($80m), Charge+Zone ($54m), Magenta Mobility ($40m), ConnectDER ($27m) and Indra ($21m).

Four debt and public market financing deals in Q1 2023 raised $777m. There were eight public market financing deals amounting to $1.1b in Q4 2022. In a YoY comparison, $4m was raised in two public market financing deals in Q1 2022.

In Q1 2023, there were four M&A transactions compared with two transactions in Q4 2022. In a YoY comparison, there were three transactions in Q1 2022.