More advances needed before eVTOL mass deployment

- April 2, 2024

- Steve Rogerson

Considerable technology advancements are still required to make widespread smart-city deployment of electric vertical take-off and landing (eVTOL) aircraft a reality, according to a report from IDTechEx.

Flying cars are very easy to hype, says the report. Most images of the future almost always include mass mobility in the air. It is one of the staples of any depiction of advanced modern societies and a trope of almost every science fiction movie or book, however dystopian. It is an exciting time where the level of technological advancement is reaching the stage of making eVTOL aircraft feasible.

However, considerable advancements, such as in battery energy density and charging capabilities, distributed electric propulsion systems, composite materials, and mass aircraft manufacture, are still required to make widespread deployment a reality.

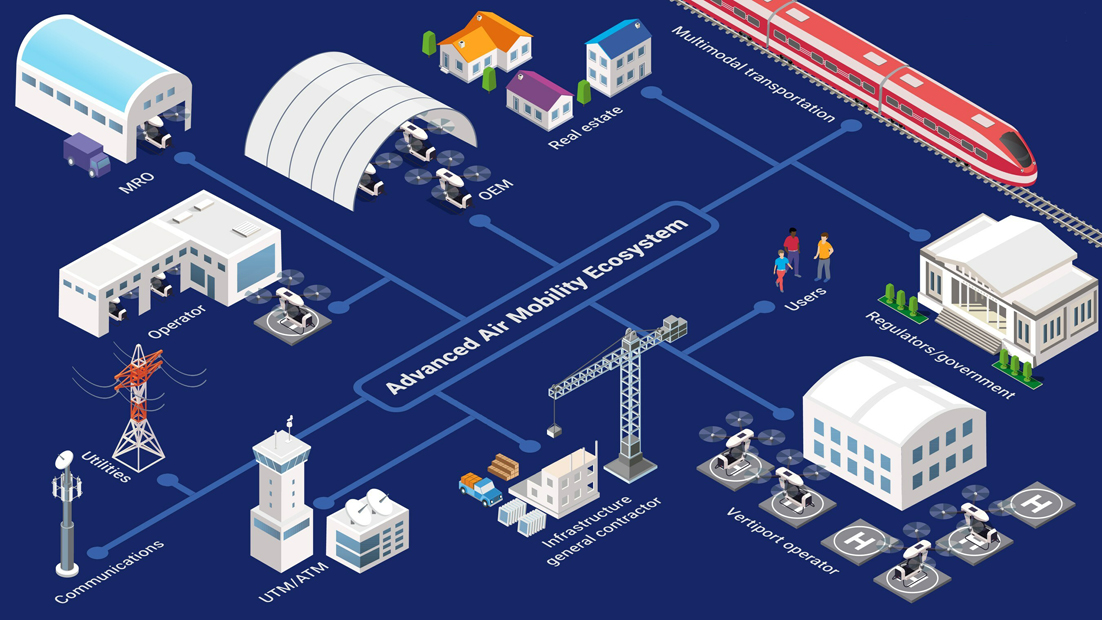

There are also many challenges not related to the technical feasibility of making an eVTOL fly that will also need to be addressed, including certification of aircraft and parts, regulation of operations, public acceptance, and the development of ground infrastructure.

The report (www.idtechex.com/en/research-report/air-taxis-electric-vertical-take-off-and-landing-evtol-aircraft-2024-2044-technologies-players/998) is intended to help companies understand the emerging urban air mobility (UAM) market.

Many of the world’s largest aerospace and automotive companies are ramping up their interest in eVTOL aircraft, recognising it as a potentially disruptive transport mode. The major aerospace suppliers – RTX, GE, Safran and Honeywell – are all investing in eVTOL-related technologies, including electric and hybrid-electric powertrain components, systems for autonomous flight, and air traffic management systems.

Furthermore, composite material manufacturers such as Toray and Hexcel have been working with OEMs on the lightweight materials required for several facets of eVTOL design. The automotive industry is also taking an interest, with Toyota, Hyundai, Stellantis, XPeng, Suzuki and Honda all funding, collaborating on or conducting their own eVTOL projects.

Hundreds of concepts of eVTOL aircraft have been introduced in recent years. However, very few have actually flown, and even fewer have any outlook for certification, commercial launch or operations at scale. Some handful of eVTOL companies hope to receive regulatory certification for their eVTOLs by the middle of the decade.

The years leading up to 2024 saw some OEMs finishing the assembly of type-conforming eVTOLs, which is an important step on the path to achieving the type certification required to begin commercial passenger operations. Full-scale demonstrators have also been made by a few OEMs. These demonstrators are usually larger and more advanced than scale models or prototypes, representing a step towards the eventual commercialisation of eVTOL aircraft.

In 2023, companies also took steps forward with production facilities, announcing site-specific plans. Manufacturers are improving the chances of scale-up by taking steps to make production more efficient, which will enable more rapid production of serial aircraft and aircraft systems at lower costs. Those to market first will have the opportunity to be the face of this market as a brand leader at the technological forefront. The advent of this market also opens up a value chain that will support the successful commercial operations of eVTOLs.

Much of the focus for batteries has been on cost per energy storage, for example dollar per kilowatt-hour. But for aviation, which fights a constant battle against gravity, the metric of energy density (watt-hour per kilogram) is more essential. The industry must achieve the battery performance required to sustain electric vertical takeoff and landing. To enable this, battery density must nearly double from today’s approximately 200 watt-hours per kilogram, and these batteries must achieve aviation-grade safety standards. This is critical to reduce the noise and cost of operating these vehicles.

The report provides detail from the basic pros and cons of the different eVTOL aircraft design architectures, through to more nuanced detail on opportunities in enabling technologies, such as aviation grade batteries, electric motors and propulsion systems, composite materials, and eVTOL ground infrastructure. It contains IDTechEx’s 20-year outlook for eVTOL air taxi sales, market revenue, battery demand and battery market revenue.