Inflation and chip shortage are biggest headaches for CEOs

- August 4, 2021

- Steve Rogerson

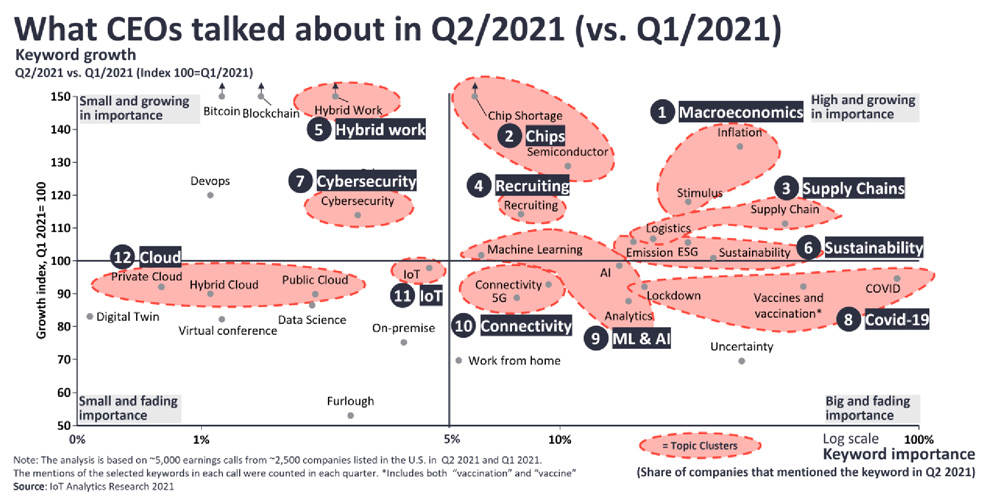

Inflation, chip shortage, supply chain problems and recruitment are the big issues facing corporate CEOs, but technology topics, including 5G, IoT and the cloud, are declining in importance, according to IoT Analytics.

The market watcher conducted a keyword analysis of nearly 2500 earnings calls of US-listed companies.

The global economy is projected to grow 5.6% in 2021, its strongest post-recession pace in 80 years. But not all companies have returned to pre-Covid-19 levels.

“Disrupted supply chains and the ongoing chip shortage are two of the topics dominating CEO discussions, alongside the fear of rising inflation and the search and competition for the best talent,” said Knud Lasse Lueth, CEO at IoT Analytics.

Philipp Wegner, senior analyst at IoT Analytics, added: “In general, Q2 boardroom talks reflect a certain level of excitement and willingness to plan rather than manage the unforeseeable. Uncertainty and remote working topics have faded in importance, while discussions about managing hybrid work surged, with divided opinions.”

The chart visualises keyword importance and keyword growth. The x-axis measures keyword importance, that is how many companies mentioned the keyword in earnings calls in Q2. The further out on the x-axis, the more often the topic has been mentioned. The y-axis measures keyword growth, that is the increase or decrease in mentions from Q1 2021 to Q2 2021, indexed to 100. A number above100 on the y-axis indicates the topic has gained importance, while a number below 100 indicates the topic has decreased in importance.

Inflation was mentioned in 32% of the earnings calls, a 35% increase. The term “stimulus” recorded similarly high growth in importance. It was mentioned in 23% of the earnings calls, an 18% increase. These phrases superseded last quarter’s leading topics – vaccination, lockdown and Covid-19.

Inflation stood out as a theme, with many companies noting that the prices of supplies have increased across the board.

“We have experienced a spike in transportation and logistics costs, which is especially acute when we have been required to purchase spot capacity to satisfy the strong demand for our products,” said Ozan Dokmecioglu, chief financial officer at Keurig Dr Pepper.

The keywords “chip shortage” and “semiconductor” were mentioned by roughly 27% of all companies, an overwhelming 155% and 29% increase, respectively. A few months ago, IoT Analytics reported that the increase in demand for semiconductors and the short-term shortage had impacted many industries, as semiconductors were used in a wide variety of products. The shortage is lasting longer than initially anticipated.

However, while demand remains strong, some CEOs are optimistic that their money has not been lost, and revenues have merely been deferred.

“5G, automotive, high-capacity computing, AI, machine learning and IoT are all drivers of more silicon devices packaged in more mobile ready configurations that are driving tremendous growth across all sectors of the semiconductor market,” said Stephen Schwartz, CEO of Brooks Automation . “What’s more, we’re beginning to witness the start of a resurgence in the memory chip sector, which will compound the already robust level of foundry and logic spending.”

The keywords “supply chain” and “logistics” were mentioned by roughly 42% and 18%, up 11% and 7%, respectively. In a more interconnected world with just-in-time production, supply chains are highly vulnerable. Manufacturers in some industries have little inventory on hand and few back-up supply sources, so when plants were shut down due to the pandemic or the passage of goods through the Suez Canal was blocked, the effects were felt immediately. The current shortages and disruptions are more widespread and significant than those of the past, but they are still expected to be transitory.

“On the supply chain front, we continue to manage through the constraints seeing industry wide and continue to incur additional costs,” said Scott Herren, chief financial officer at Cisco. “We are partnering with our key suppliers, leveraging our volume purchasing and extending supply commitments as we address the supply chain challenges, which we expect will continue.”

Recruiting was mentioned by roughly 8% of all companies, a 14% increase. As demand for goods increases in a post-Covid-19 world, so does the need for workers. Employees with digitalisation skills are especially valuable.

A recent McKinsey study found the pandemic accelerated existing trends in remote work, ecommerce and automation.

“So we’re very focused on the recruiting side right now, and we really pivoted, of course, during the pandemic,” said Catherine Corrigan, CEO of Exponent. “We’ve been able to really take advantage of the virtual space from the standpoint of the way that we are sourcing candidates. We gain these candidates through a variety of channels.”

A still tiny but fast-growing topic is hybrid work. The term was mentioned in roughly 2% of the earnings calls, a 108% increase. Most workers and employers believe the future of work will combine remote and on-site work, thus hybrid work. Some surveys report that people are more productive and happier when working from home and want to continue working remotely half the time as the lockdowns lift.

Digital conferencing providers, such as Zoom, are preparing tools to integrate both worlds. Real estate services are considering how to best use building spaces.

“Zoom is here to help each customer calibrate their future working model in their own way,” said Eric Yuan, CEO of Zoom Video Communications. “Many companies are redesigning the workplace to enhance the hybrid work experience. So to meet this need, we announced Zoom’s features such as Smart Gallery, which puts in-room and remote participants on equal footing, virtual receptionist, participant accounting and environmental sensors.”