Smart meter installations to take off post Covid-19, says Berg

- June 16, 2020

- Steve Rogerson

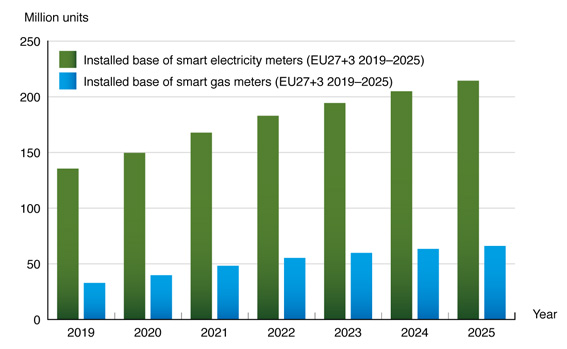

Despite smart meter installations put on hold due to Covid-19, smart energy meter shipments in Europe are expected to reach a record level of 34.8 million units in 2021, according to Berg Insight.

Temporarily postponed meter installations due to Covid-19 are expected to have a slightly negative impact on shipment levels in 2020 and the total number of smart meters installed during the year is anticipated to be ten per cent lower compared with the previous year.

Annual smart electricity meter shipments amounted to 20.9 million units in 2019 and the corresponding figure for smart gas meters was 8.5 million units.

“Although the Covid-19 pandemic has forced the field work of several major smart metering projects to pause temporarily, the market is nonetheless expected to remain robust with the cumulative number of smart meter shipments being largely unaffected over a three-year period,” said Levi Ostling, IoT analyst at Berg Insight.

Major first-wave rollouts in countries such as France and the Netherlands are expected to be completed according to timelines in the next couple of years while the largely delayed UK rollout is forecasted to ramp up during the same period. Meanwhile, Italy is now in the late stages of its deployment of smart gas meters as well as in the midst of its second-wave rollout of smart electricity meters, contributing with significant volumes in the next few years.

With large-scale second-wave rollouts also beginning in Sweden and Finland during 2020-2021, upgrades of first-generation smart electricity metering systems are forecasted to account for 30 to 35 per cent of annual European smart electricity meter shipments from 2020 to 2024.

Central and Eastern Europe will account for an increasing share of smart meter shipments in the 2020s as mass-deployments in Western Europe are being completed while the widespread take-off of second-wave rollouts is still years into the future.

While the German market is expected to be a slow burner with a partial rollout until 2032, the outlook is looking more positive for Austria, Switzerland, Poland, Lithuania, Romania and Croatia.

“Central and Eastern Europe markets are expected to account for as much as 46 per cent of annual EU27+3 smart meter shipments in 2025, up from nine per cent in 2019,” said Ostling.