E-Pop raises $2m to connect shoppers and retailers

- January 17, 2023

- Steve Rogerson

New York-based fintech start-up E-Pop has surpassed $2m in a seed funding round.

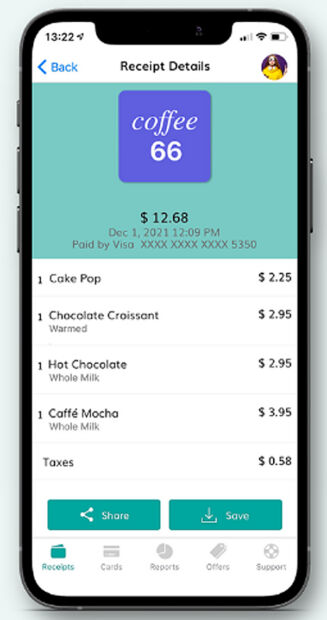

It has developed a two-sided platform connecting consumers and retail merchants via a smart digital receipt.

The funding will be used to fuel operational expansion and hiring, enrich data aggregation and customer behaviour analytics for merchants, and facilitate further payment integrations.

The start-up has an office in London and a presence in the Middle East. Its ecosystem delivers merchants and partners granular insights into consumer behaviour as well as channels by which to engage, advertise and market to existing and new shoppers.

For consumers, the technology provides more control and security over the use of personal contact data and a single mobile app to receive receipts, discounts and return notifications, and track spending across accounts.

“I am delighted to complete our seed raise, particularly given challenges and uncertainty in economic conditions globally,” said Sunay Shah, co-founder and CEO of E-Pop. “With this round, we are delighted to fuel development of our ecosystem, partner with marquee retail brands, SMEs, carbon initiatives within corporate and government sectors, and payment technology leaders. New capital enables us to achieve this by expanding our talented team of ten and drive new users in key markets.”

With mainstream advancements in digital banking and payments and intensified focus on consumer data privacy and security, Shah said there was not only tremendous potential to enhance retail analytics but an impetus to improve both the consumer experience and merchant intelligence.

“Additionally, the effectiveness of digital advertising across all channels will continue to be negatively impacted due to heightened privacy policies and a lack of visibility into consumer activity and habits,” said Shah.

E-Pop’s technology highlights the items consumers are actually spending money on and provides a trusted and targeted channel to reach them, while protecting customer identity.

“Today’s consumers shouldn’t have to sacrifice privacy with merchants in order to have a relevant, stellar user experience in the form of tailored discounts and a personalised customer journey,” said Shah. “It’s a win-win for everyone involved in the shopping journey including our planet.”

While the retail sector has typically experienced improvements that are slow-moving and incremental, a global pandemic, greater emphasis on climate change, and enormous changes in the way consumers shop and pay have accelerated the need for smarter data technology that delivers personalised experiences and drives customer satisfaction.

E-Pop stands for “electronic proof of purchase” and is transforming the way consumers and businesses think about environmental sustainability, eliminating paper receipts altogether while delivering retail merchants greater data, analytics and insights, and providing a consumer engagement channel. An environmentally safe and efficient alternative to paper receipts, it automatically sends transactions securely to its mobile app with itemised receipts without consumers needing to share their email information with every merchant.

E-Pop was co-founded by Sunil Rajan and Sunay Shah with the aim of enabling sustainable practices for consumers and businesses and making shopping experiences and daily activities more efficient.