Three in four electricity meters in North America are smart

- January 9, 2023

- Steve Rogerson

Three-quarters of electricity meters in North America are now smart, according to IoT analyst firm Berg Insight.

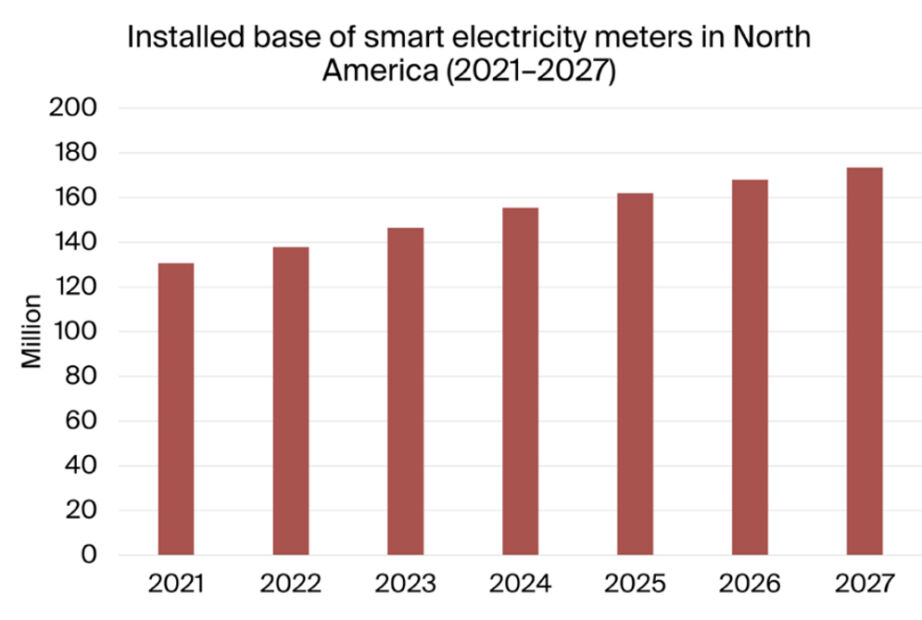

Its recent report reveals the penetration of smart electricity meters in North America reached 74 per cent in 2021. Overall, the installed base of smart electricity meters will grow at a compound annual growth rate of 4.8 per cent from 2021 to 2027 to reach a total of 173.4 million units at the end of the forecast period.

Over the next six years, the penetration of smart meters in the USA will increase to reach a level of 93 per cent while the respective figure for the more advanced Canadian market will be slightly higher at 94 per cent.

“First-wave deployments will continue to grow in the coming years and will be driven by the launch of major new projects by late adopters in the north-eastern USA and eastern Canada,” said Mattias Carlsson, IoT analyst at Berg Insight. “Meanwhile, second-wave rollouts for early adopters are now also ramping up and will grow their share of annual shipment volumes from around 12 per cent in 2021 to around 75 per cent by 2027.”

According to the study, yearly shipments of smart electricity meters in North America will grow from 10.7 million units in 2021 to 17.3 million units in 2027.

Covid-19 had a notable impact on deployments during 2020 with a year-over-year decrease of around 13 per cent in annual shipment volumes. The market has since experienced an increase in shipments and the number of yearly shipments is expected to peak in 2024 at 18.4 million units and thereafter slightly decrease to a level of 17 million units until the end of the forecast period.

Alongside the increase in replacement smart meter projects, the development of smart metering technology in the North American market has in the last couple of years shifted focus to serving new demands beyond smart metering. The utilities are now looking to leverage their existing network canopies for a wider array of smart city applications while also trying to figure out how to cope with the integration of the rapidly increasing number of electric vehicles and distributed energy resources into the grid infrastructure.

“The race has begun between the top vendors to develop and successfully commercialise the most attractive use cases for second-wave smart metering technology,” said Carlsson. “Besides increased computing power and edge analytics capabilities that enable a new set of benefits, utilities are more and more looking to integrate multiple smart city applications into a single solution.”