Public ITS set for up to 8.1% CAGR, says Berg

- October 11, 2022

- Steve Rogerson

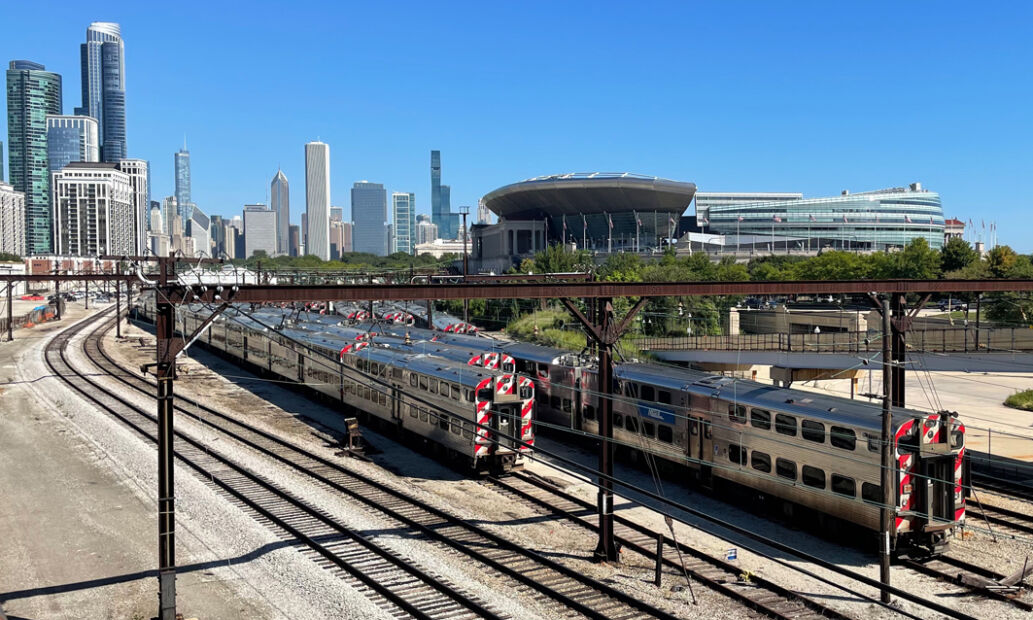

The public intelligent transport system (ITS) market in Europe and North America is set to reach €3.9bn by 2026, according to market researcher Berg Insight.

The estimated market value for ITS deployed in public transport operations in Europe was €2.12bn in 2021. Growing at a compound annual growth rate (CAGR) of 5.8 per cent, this is expected to reach €2.81bn by 2026. The North American market for public transport ITS is similarly forecasted to grow at a CAGR of 8.1 per cent from €0.76bn in 2021 to reach €1.12bn in 2026.

Berg believes the market for ITS in public transport is in a growth phase which will continue throughout the forecast period. A growing awareness among public transport providers of the benefits of ITS along with increasing demands from travellers for convenience and accessible real-time information contribute to a positive market. In addition, governments in both Europe and North America see public transport as a prioritised area for investment.

For instance, the US Bipartisan Infrastructure Law, passed in November 2021, has allocated up to $108bn for investments in the modernisation of public transport between 2022 and 2026.

A group of international aftermarket providers have emerged as market leaders for public transport ITS. Major providers across Europe and North America include Canada-based Trapeze Group and Germany-based Init with significant installed bases in both regions. Clever Devices and Conduent hold leading positions on the North American public transport ITS market. The former has expanded into Europe with an acquisition and the latter is an international provider of fare collection systems.

Additional companies with notable market shares in North America include Cubic Transportation and Avail Technologies. Examples of major vendors on national markets in Europe include Equans and RATP Smart Systems, which hold leading positions in France, and IVU, which is an important player primarily in the German-speaking part of Europe. Vix Technology, Flowbird and Ticketer are major providers in the UK.

Other significant players include the Spanish groups GMV, Indra and Grupo Etra; French Thales; Atron in Germany; Scandinavian Fara and Consat Telematics; and Austria-based Swarco and Kontron Transportation. Volvo and Daimler are notable players from the vehicle OEM segment, while companies such as Scania, Iveco, Gillig and New Flyer also offer some conventional OEM telematics features for their buses.

“The penetration rate of on-board computers featuring GPS location functionality and wireless communications has now reached very high levels, especially in urban areas in North America and Western Europe,” said Caspar Jansson, IoT analyst at Berg Insight.

The Mediterranean countries and Eastern Europe are working on catching up.

“This development was reinforced by the Covid-19 pandemic,” said Jansson, adding that because of the pandemic, an accelerated adoption of modern ITS can be seen as a way to comply with the restrictions on human contact and to reduce the complexity of using public transport.

“Many operators have for example installed new contactless ticketing and passenger counting systems over the last two years, to make the lives of commuters easier,” he said.